PREFACE

Dear friends,

Welcome to Harbin!

Now, you have a number of payment service options at your fingertips while staying in Harbin, ranging from mobile payment, bank cards to RMB cash. Please follow this guide to find out how to get and use each type of payment service.

We wish you a pleasant and enjoyable stay in Harbin!

1.Bank card

Bank cards are accepted where you can see logos of your card schemes such as UnionPay, Visa, and MasterCard. If you have any doubt, you can ask the cashier for more information.

Tips: Please make sure that your bank card is accepted in the Chinese mainland, as prior approval from the issuing bank is required for some cards to enable the cross-border payment.

2.RMB Cash

There are five ways to withdraw or exchange for RMB cash.

①Bank branches

Bank branches with the logo of “EXCHANGE” can provide you with services such as foreign currency exchange, RMB cash change and exchange rate inquiries. A valid ID document is often required.

To check the location of nearby bank branches with currency exchange services, you can visit the banks’ official websites or dial their service hotlines.

②Self-Service Machines (E.g. ATM, CRS, etc.)

You can withdraw RMB cash at ATM, CRS and other self-service machines with logos of your card schemes. The upper limit of a single withdrawal is CNY3,000 which is also subject to the limit of your bank cards.

③Franchised Institutions for Foreign Currency Exchange

You can exchange currencies at counters of franchised institutions for foreign currency exchange where the “EXCHANGE” logos are often shown. Daily limit per person is the equivalent of USD 5,000, and annual cumulative limit is the equivalent of USD 50,000.

④Foreign Currency Exchange Agencies

You can exchange foreign currency cash for RMB cash at foreign currency exchange agencies, usually located at airports or hotels. Daily limit per person is the equivalent of CNY 10,000, and annual cumulative limit is the equivalent of CNY 50,000.

⑤Self-service Foreign Currency Exchange Machines

You can exchange currencies on a self-service foreign currency exchange machine with your valid ID document. The daily limit per person is the equivalent of CNY 5,000.

3.Mobile Payment

You can enjoy convenient payment services with just a mobile phone. Payment services such as UnionPay QuickPass, Alipay and WeChat Pay are available.

①UnionPay QuickPass

Step1: Download and install the UnionPay QuickPass APP

Step2: Register

Download the UnionPay QuickPass App in your app store and click “Register”. If you have arrived in China, please ensure that your mobile phone is enabled for international roaming and can receive registration SMS. Alternatively, you can complete your registration before your arrival.

Step3: Add bank cards as shown below

Tap [Add Now] and follow on-page prompts to complete the process.

*Note: It only supports linking UnionPay cards issued in certain places such as Hong Kong SAR and Macao SAR.

Step 4: Ready for payment

A. Click [Scan]-Scan the merchant’s QR code.

B. Or Click [Pay & Receive]-Show your QR code to the merchant.

C. For consumer apps: Select UnionPay QuickPass App in the payment method list upon checkout.

Q: Where can UnionPay app be used?

A: It can be used at merchants with UnionPay QR code brand mark.

②AlipayQuick Set-up in 2 Steps

1. Download and register

2. Add bank cards

Pay Easily with Alipay

Option 1Tap [Scan] and scan the QR code presented by the merchant.

Option 2Tap [Pay/Receive] and show your QR code to the merchant.

FAQ

Q: Where can I pay with overseas bank cards using Alipay?

A: Consumers can add overseas bank cards to their Alipay accounts and pay for daily purchases within the Chinese mainland. Overseas bank cards do not support person-to-person transfers, sending or receiving red packets, wealth management services, insurance services, or other financial services.

Q: How do I know the exchange rate of the transactions made with overseas bank cards on Alipay?

A: The exchange rate for overseas bank cards is provided by the card scheme and issuing bank to which your card belongs. Please refer to the billing statement of your bank card.

③WeChat Pay

Quick Set-up in 2 Steps

Step1:Download WeChat

Please download or update the WeChat app to the latest version on your mobile phone. Register or sign in with your phone number.

Step 2: Add bank cards to WeChat

You can add your card in any of the following ways.Simply enter your card number, expiry date, and security code, with no need to filling in identity information.

Method 1: Open the WeChat app, tap[+]>[Scan] on the top right corner to scan the following QR code.

Method 2: Tap [Me]>[Services]>[Wallet]>[Bank Cards],and add your card to WeChat.

How to use WeChat Pay?

Method 1: Scan to pay.

Method 2: Present your payment code to the offline merchants.

Method 3: Select WeChat Pay in the merchant’s app to complete the payment.

Tips:

1. UnionPay QuickPass, Alipay and WeChat Pay all support binding overseas mobile phone numbers. Just make sure that your mobile phone has enabled international roaming.

2. The single payment limit for overseas visitors using mobile payment in the Chinese mainland is USD 5,000, and the annual cumulative limit is USD 50,000.

3. Please call the following hotlines if you have any questions or need further information.

Service Hotlines in English

UnionPay QuickPass: +86-95516

Alipay: +86-571 2688 6000

WeChat Pay:+86 57195017

4.Bank Account Services

You can open a bank account at a local bank branch in Harbin with a valid ID document, such as Passport, People’s Republic of China Foreign Permanent Resident ID Card, Mainland Travel Permit for Hong Kong and Macao Residents, Mainland Travel Permit for Taiwan Residents and other ID documents required by PRC laws and administrative regulations. When you apply for a bank card in China, banks are required to conduct due diligence in accordance with internationally accepted practices, and your cooperation is required. The domestic account opening bank will carry out proper categorisation and grading management based on the result. You can inquire about the specific conditions at the branch or check the bank’s official website.

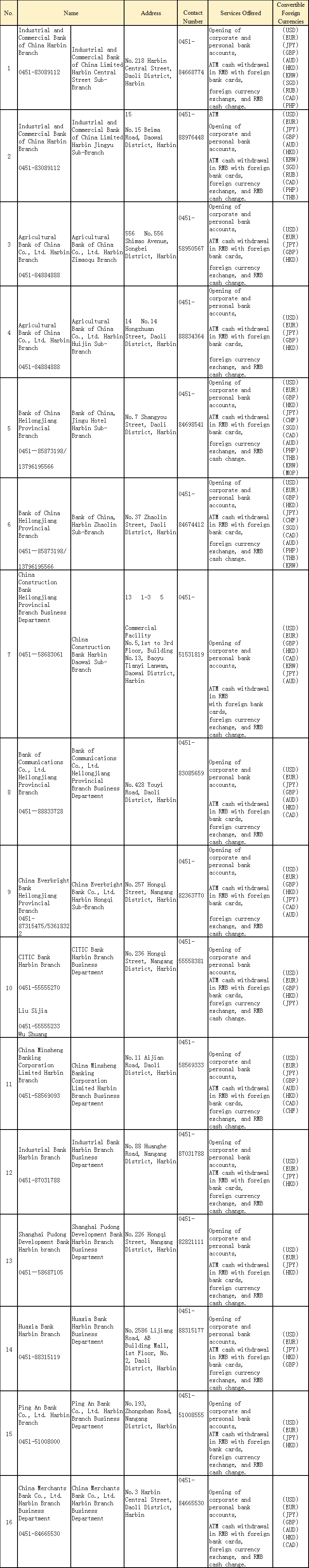

Bank Outlets Offering Account Opening, ATM Foreign Card Withdrawals, and Currency Exchange Services

Bank Outlets with Self-service Currency Exchange Machines

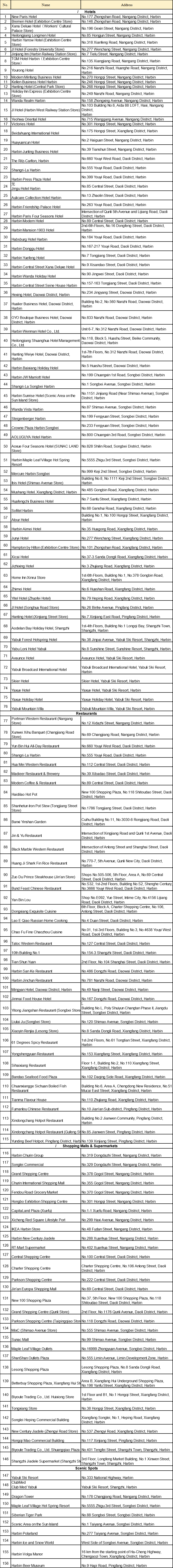

List of Key Merchants Accepting Overseas Bank Cards

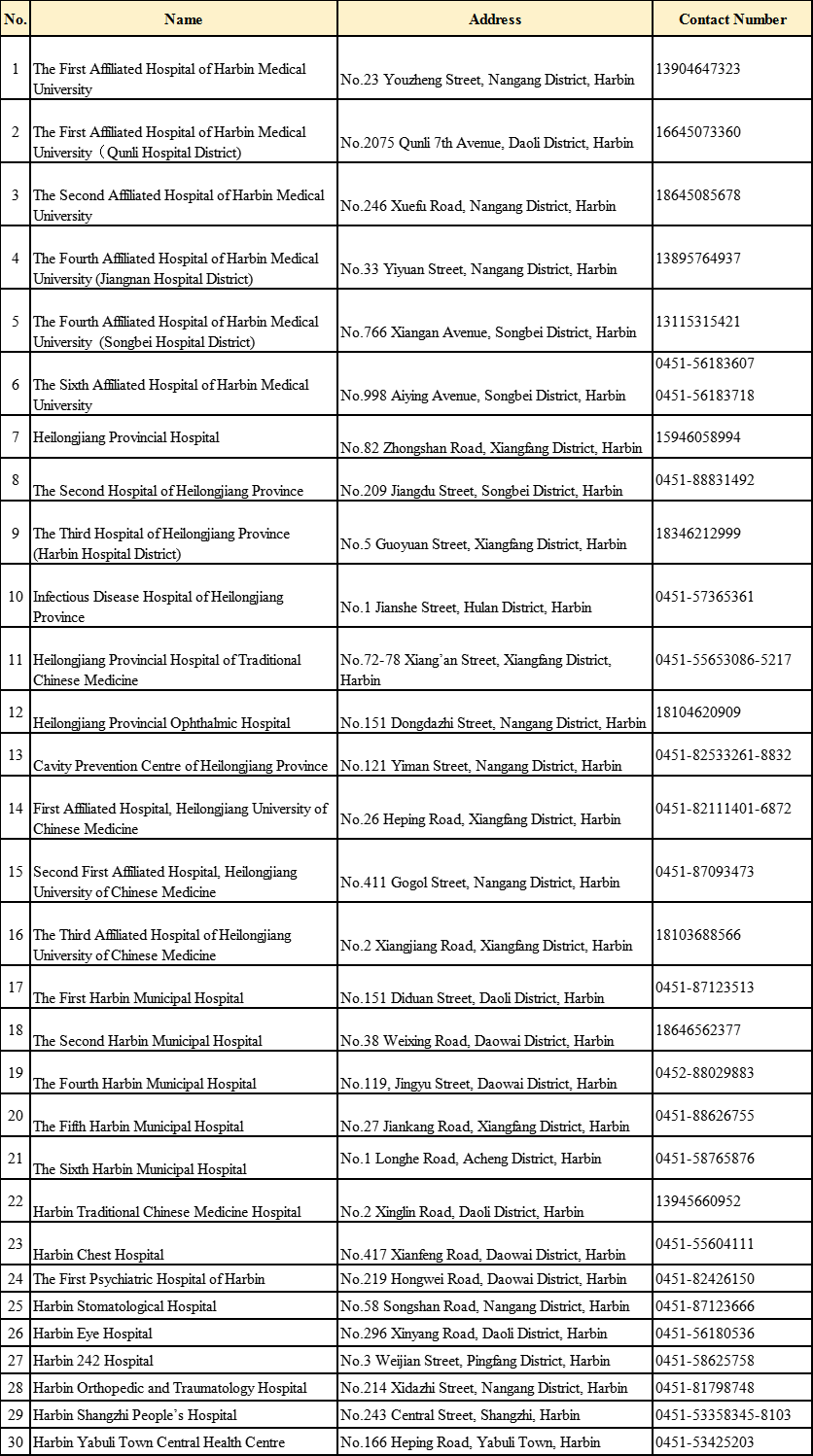

Medical Institutions Accepting Foreign Card Payments